2022-09-29

By: Advocate Brokerage

As we look toward the end of 2022 and preview into the new year ahead, we keep hearing that rates are increasing will all insurance carriers across the board. Educating each client we serve is important to us which is why we feel we need to share as much information as possible.

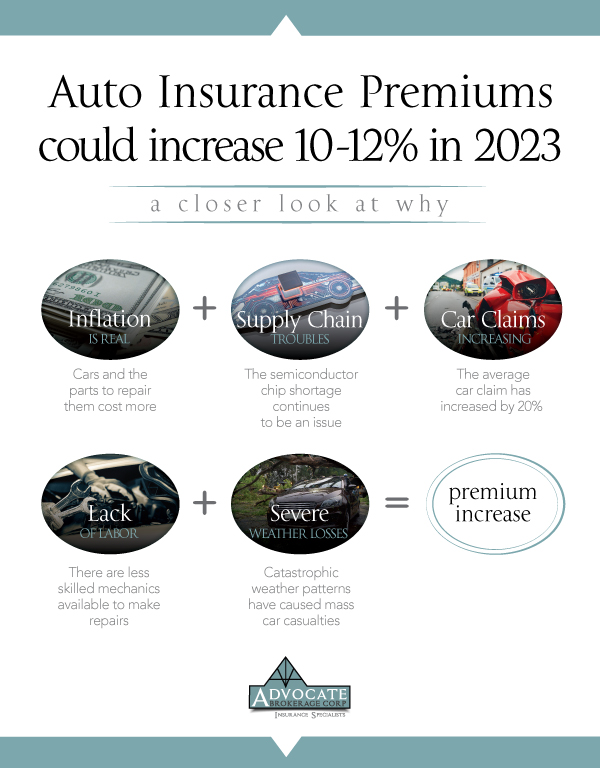

Auto insurance premiums could increase as much as 10 – 12% in 2023

Let’s Take A Closer Look At Why

Inflation Is Real

The biggest factor affecting car insurance premium increase is INFLATION. That means that…

Cars Cost More

Between 2020 and 2021 the cost of purchasing a new car increased by nearly 17% (according to a report from the Zebra). Used car prices have also seen a dramatic increase, as much as 26% (according to The Consumer Price Index).

Parts Cost More

On average the cost of parts has gone up by 6%. Vehicles are also much more complex, which means that when it comes to fixing cars after an accident, even a small incident can cause thousands of dollars’ worth of damage to delicate electronics. This is especially true for those who drive luxury vehicles, some carriers will not write new policies for certain makes and models because of the large expense involved in having them repaired.

Supply Chain Troubles Continue

The semiconductor chip shortage continues to be an issue. This lack of supply has left thousands of new vehicles unusable as they wait for their chips to arrive, a shortage that is likely to continue into 2024.

Car Claims Continue To Increase

The average car claim has increased by 20% (according to a report from Travelers). There are more people on the road than ever, and this has caused an increase in accidents. Unfortunately, we’ve also seen an increase in the severity of the accidents as well, the number of fatal care crashes is up by as much as 18% (according to the National Highway Safety Traffic Administration).

Lack Of Skilled Labor

There are less mechanics available who have the necessary training and skill to repair today’s sophisticated vehicles. This lack of skilled laborers coupled with a 9% increase (according to the US Bureau of Labor Statistics) in wages has contributed to the increase in the cost of claims.

Severe Weather Losses Affects Car Insurance Too

The catastrophic weather we’ve experienced over the last few years has caused mass car casualties. There were over $20 Billion in losses from weather disasters in 2021 alone (according to a study done by the National Centers for Environmental Information).

The bottom line is…

When You Own An Expensive Car,

Don’t Cheap Out On Your Auto Insurance

We are all concerned about the continuing increase in auto insurance rates, however if you own a luxury vehicle, you need to take some things into consideration.

First and foremost, not all auto insurance policies are the same. We have never made it a secret that we prefer our clients insure their automobiles with one of our elite carriers. Our experiences have shown time and time again that if you own an expensive car, in the long run, it never makes sense to cheap out on your insurance. After an accident, or a loss due to storm damage is not the time to find out you don’t have the type of coverage best suited for your vehicle.

Below are a few things that stand out when it comes to choosing one of our preferred carrier partners to insure your luxury vehicle:

We really do have your best interest in mind when we recommend certain coverage and certain carriers. In fact, we will obsess about providing the best coverage for your car. If you have any questions, talking with an insurance specialist like the ones at Advocate Brokerage about what you can expect for the future is a good idea. Call us at 914-723-7100 at any time.