2022-05-24

By: Advocate Brokerage

If you’ve been receiving our newsletters for any length of time, you’ve heard us talk about rising insurance rates. Our partner companies automatically increase your coverage limits to keep up with the rising costs we are experiencing.

Inflation has a direct correlation to rising insurance rates. With inflation in the United States reaching historic rates – the highest it has been since June of 1982, making sure your home is protected is on the top of our mind.

A new survey from the American Property Casualty Insurance Association (APCIA) revealed that many homeowners have not taken the proper steps to ensure that their insurance coverage will be adequate should they suffer a claim. The survey revealed:

Only 30% of Homeowners have increased their coverage enough to compensate for rising building costs.

33% of Homeowners may be without coverages that could offer protection from the current market conditions such as Guaranteed Replacement Cost coverage.

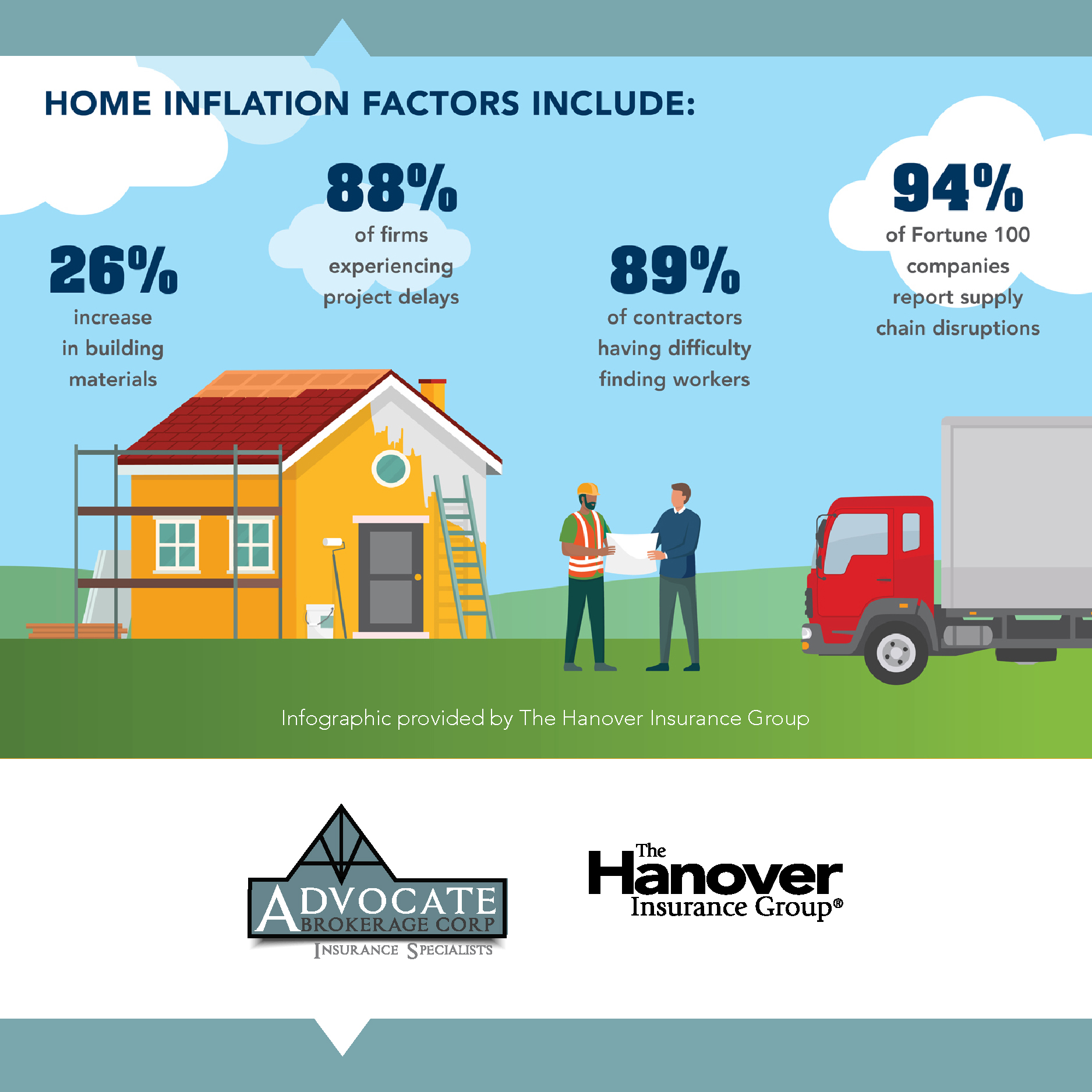

As we’ve discussed, insurance rates have been on the rise for quite some time. Let’s review what is causing them to rise:

If you have renovated your home and not informed your insurance carrier, you might be at risk for being Underinsured. Please be sure to speak with us so that we can help guide you.

For all of us here at Advocate Brokerage, it is about more than just insurance, it’s about you. We never want to see our clients file a claim and not have the insurance needed to cover the loss. If you have questions about about your insurance, we encourage you to give us a call. That is what we are here for!